How Passwordless Authentication Strengthens Operations and Client Trust

In financial services and professional services, digital expectations continue to rise. Clients want simple and consistent access to their accounts. Regulators expect firms to maintain strict, predictable identity controls. Internal teams want technology that reduces operational load rather than adding to it.

Somewhere in the middle of these competing demands, authentication often becomes a quiet source of friction. What should be a seamless beginning to the client experience instead introduces delays, support tickets, and compliance challenges that grow over time.

Legacy methods such as passwords, SMS codes, and app based MFA were never designed for today’s regulatory pressure or the client experience standards that firms now need to meet.

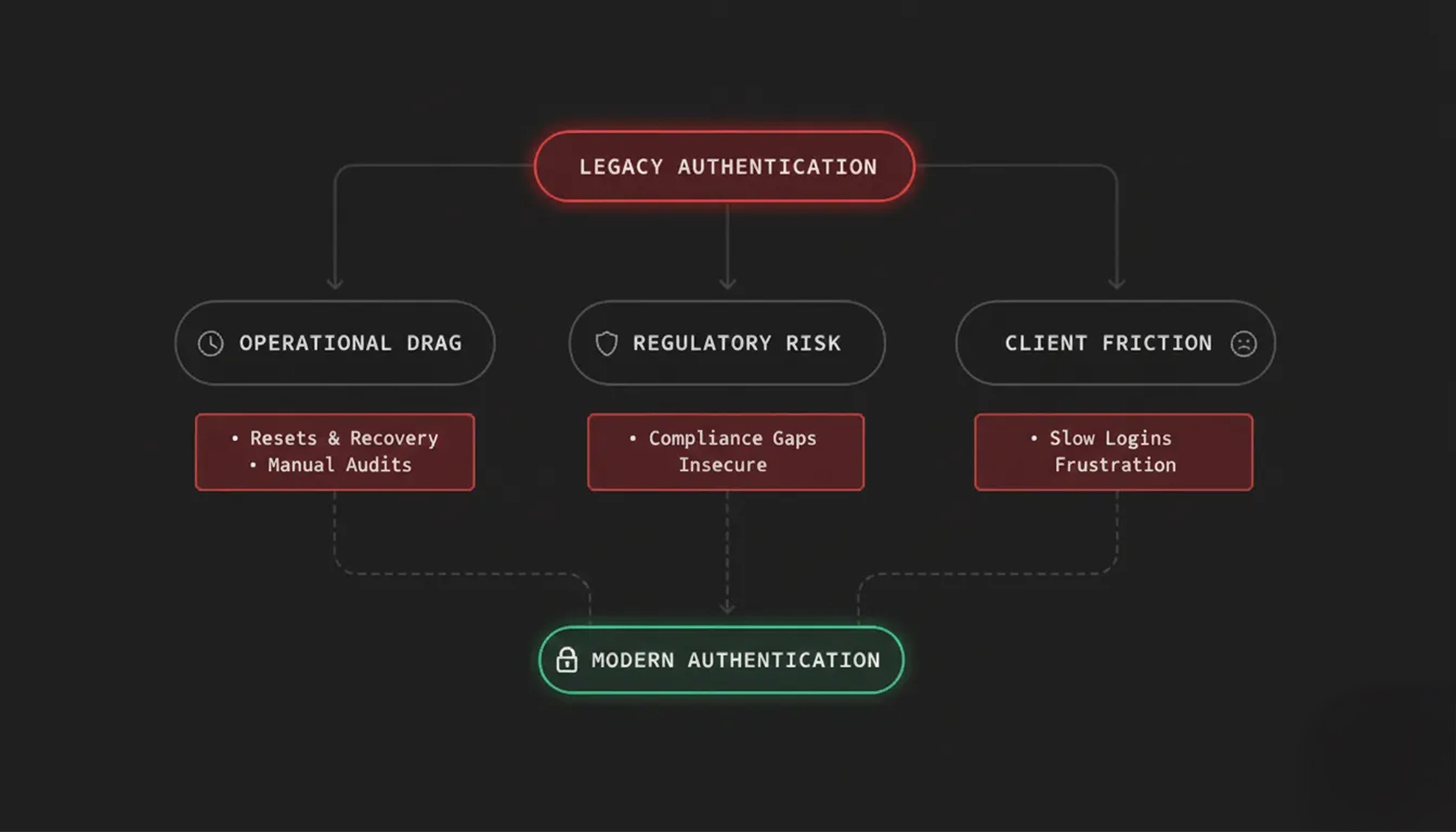

The Hidden Costs of Legacy Authentication

Operational drag that compounds over time

Password resets, recovery workflows, rotation schedules, and audit documentation drain resources year after year. For firms with lean security and IT teams, these tasks consume bandwidth that should be spent on higher impact work.

Regulatory expectations that outpace legacy tools

Frameworks such as FINRA, NIST, ISO, and SOC require identity controls that are consistent, low risk, and easy to validate. Passwords are difficult to govern at scale, prone to user error, and unpredictable by nature. Meeting compliance requirements often requires additional manual oversight.

A client experience that feels outdated

Clients expect a smooth digital experience that reflects the professionalism of the firm they are working with. Password prompts, one time codes, and multi step recovery flows slow clients down and increase frustration. Each point of friction chips away at the trust firms work so hard to build.

These challenges make it clear why regulated industries are moving toward authentication models that are more secure and significantly easier to operate.

How Passwordless Authentication Changes the Experience

Passwordless authentication removes the most fragile part of the login process. Instead of relying on something users must remember, identity is tied to a cryptographic key stored securely on the user’s device. Authentication happens through simple, familiar local verification.

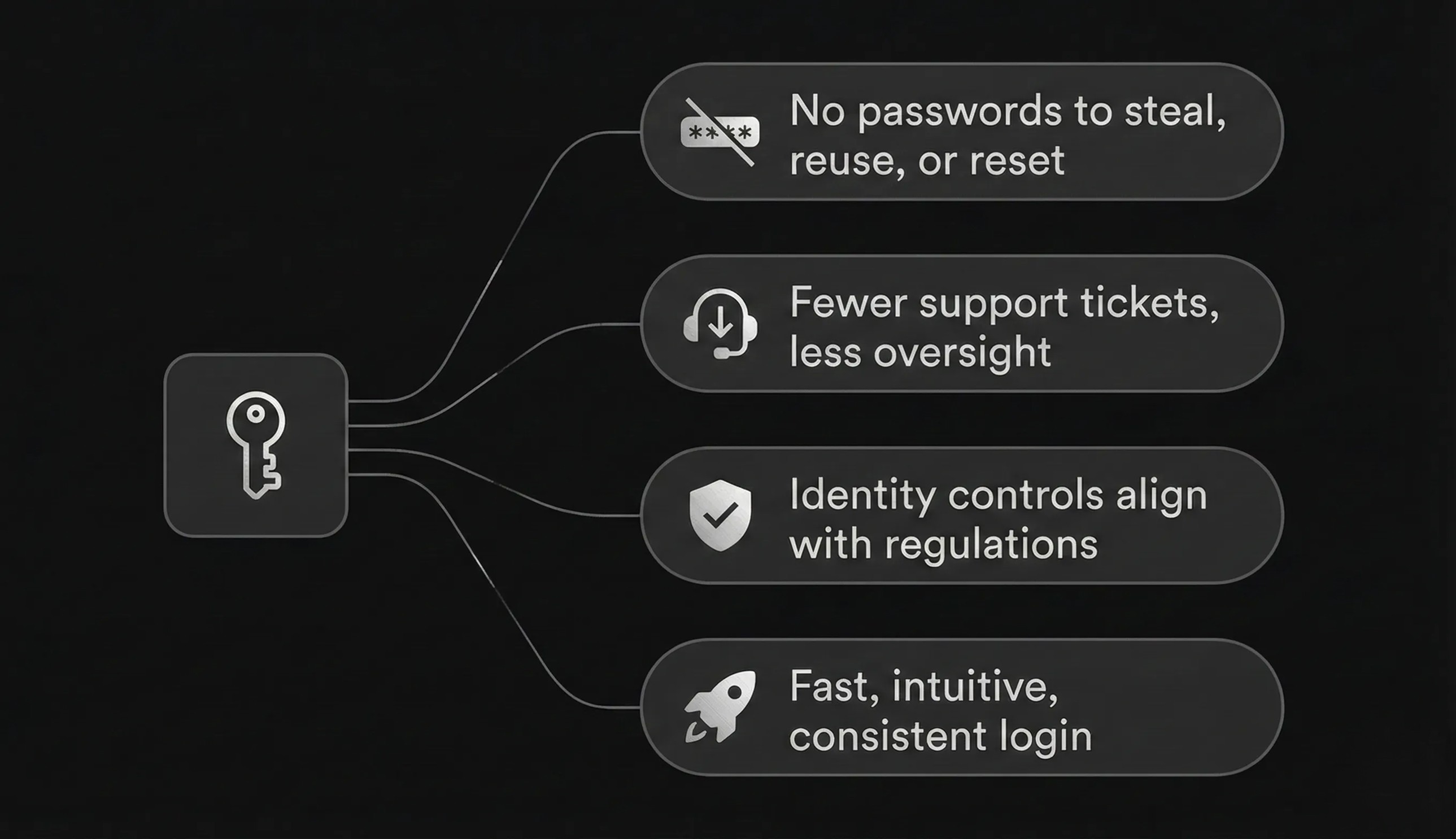

The benefits are immediate:

No passwords to steal, reuse, or reset

Fewer support tickets and less operational oversight

Identity controls that align naturally with regulatory frameworks

A login experience that is fast, intuitive, and consistent

Passwordless authentication is secure by default and removes many of the variables that make traditional systems difficult to manage.

Hawcx: Built for Regulated Organizations

Hawcx brings passwordless authentication to environments where trust, efficiency, and compliance must work together.

Operational efficiency with stronger security

Hawcx uses device bound cryptographic keys that eliminate common credential based vulnerabilities. This reduces manual intervention and simplifies identity management. Integration is fast, which helps firms strengthen security without disrupting existing workflows. Compliance becomes more straightforward because passwords are no longer part of the system.

A client experience that enhances trust

Authentication becomes almost invisible. Clients log in using familiar biometric methods on their own devices. There are no passwords or codes to manage. The process feels modern, fast, and reliable, which strengthens confidence in the firm’s digital platform.

Authentication as a brand moment

Each login is a small but significant interaction with your firm. A smooth and secure experience reinforces competence and professionalism. A clunky one sends the opposite message. Hawcx helps firms make that touchpoint a positive one.

Real Results From Firms That Adopt Hawcx

Organizations that implement Hawcx typically see:

Faster deployment timelines

Reduced operational workload from authentication management

Easier audit preparation and regulatory alignment

Higher client satisfaction with their digital experience

Conclusion

Firms in regulated industries operate in an environment where digital expectations, compliance requirements, and operational constraints all intersect. Legacy authentication systems introduce friction, increase risk, and strain internal teams.

Passwordless authentication offers a modern, secure alternative that improves compliance, reduces operational overhead, and strengthens client trust.

Hawcx delivers a solution designed for these needs. With device bound cryptography and a smooth user experience, Hawcx helps firms make authentication a reliable foundation rather than a recurring challenge.